Previously on the blog, we’ve talked about the importance of investing with intention.

We’ve also talked about how women tend to do more investment research and maintain longer-term perspectives on their financial plans than most men do.

Today, we’re going to take this a step further and talk about socially responsible investing (SRI), a topic that’s important to many of our clients.

What is Socially Responsible Investing?

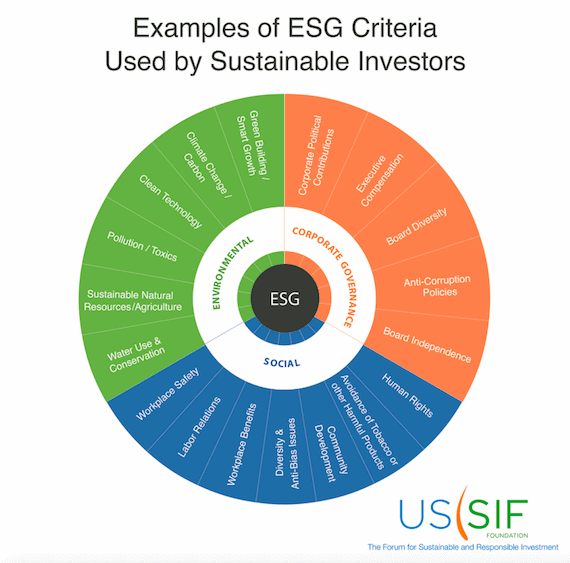

US SIF: The Forum for Sustainable and Responsible Investment (US SIF Foundation) defines SRI as “an investment discipline that considers environmental, social and corporate governance (ESG) criteria to generate long-term competitive financial returns and positive societal impact.”

Examples of ESG criteria used by sustainable investors include green building/smart growth, climate change/carbon, water use and conservation, community development, human rights, board diversity, avoidance of tobacco or other harmful products, and anti-corruption policies. SRI investors can be anyone from individuals and family offices to universities, foundations, pension funds, nonprofit organizations and religious institutions.

“Socially responsible investing” is also referred to in a variety of terms, according to the US SIF Foundation. These terms include “sustainable, responsible and impact investing,” “community investing,” “ethical investing,” “green investing,” “impact investing,” “mission-related investing,” “responsible investing,” “ethical and green investing,” “sustainable investing” and “values-based investing.” No matter the terminology, they all aim to accomplish the same thing: to grow money while doing good.

A New Wave of Socially Responsible Investors: Millennials

Sustainable investing has been around since the 1970s, but a new wave of millennial investors have entered the scene who want to make sure their investments are making a positive impact on society. They want to align their money with their values. According to US Trust, 76 percent of high-net-worth millennial and Generation Z investors have reviewed their assets for ESG impact. And according to Morgan Stanley, millennial investors are twice as likely as others to invest in companies that incorporate ESG practices.

Socially responsible investing has continued to grow astronomically over the years. At the beginning of 2018, $12 trillion in assets were invested in sustainable, responsible and impact investing strategies across the United States, according to the US SIF Foundation.

Investing Responsibly Today

At The Humphreys Group, many of our clients are invested in ESG funds, such as the Pax Ellevate Global Women’s Leadership Fund (PXWEX). The Pax Ellevate Global Women’s Leadership Fund is “the first broadly diversified mutual fund that invests in the highest-rated companies in the world for advancing women through gender-diverse boards, senior leadership teams and other policies and practices,” as described on their website.

Socially responsible investing can be a great way to align your investment portfolios with your values. If you’re interested in learning more about SRI, reach out to us today.