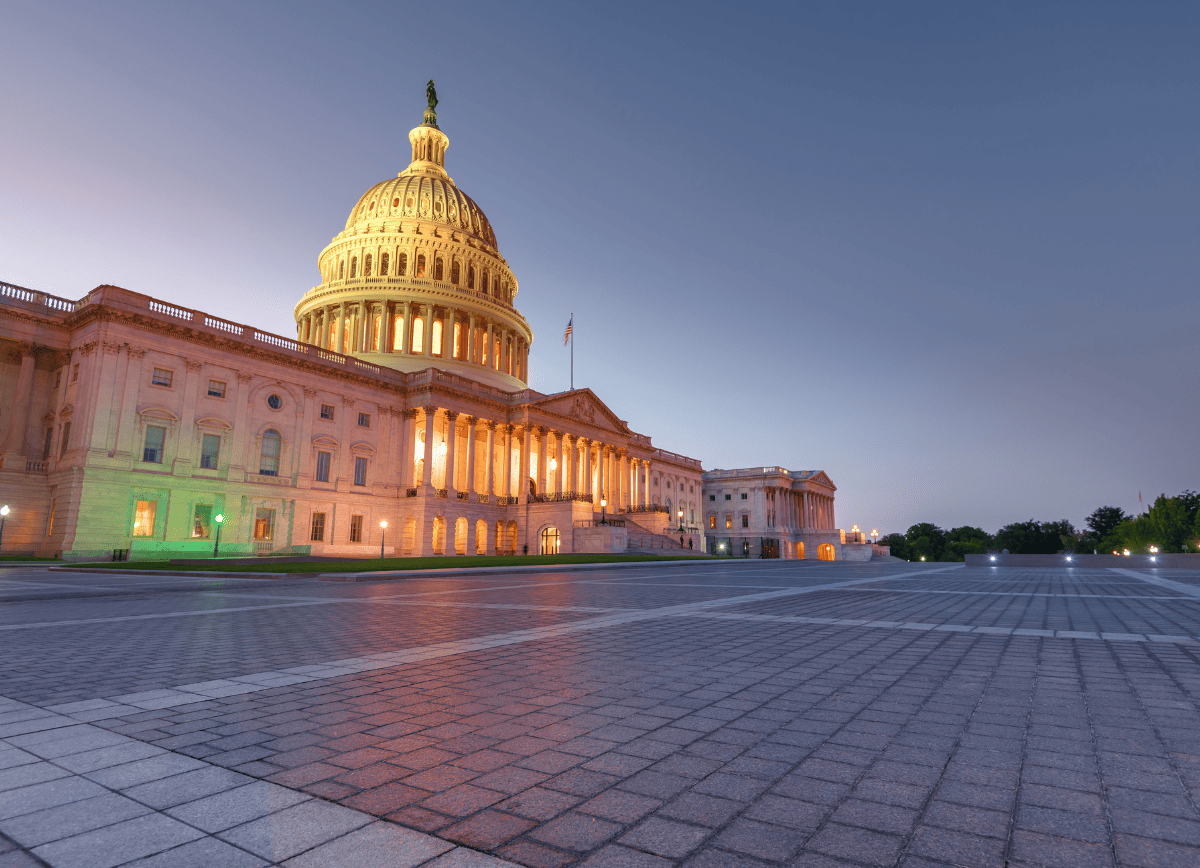

As you are no doubt aware, it is again time for the debt ceiling limit to be raised. Due to political rancor and maneuvering, there is a great deal of uncertainty as to whether Congress and the White House will come to an agreement and pass legislation before the deadline, currently estimated at June 1. Today, Biden expressed optimism that the government will not default on its debt, but as we await a consensus, we’ve put together the following FAQ to give you a sense of our perspective and our thinking – and what it all might mean for your portfolio.

Why has the debt ceiling issue suddenly become a crisis? Why is it flooding the headlines?

As always, when the debt ceiling limit must be increased, there is a level of uncertainty. This time, we have that same sense of uncertainty regarding the so-called “X Date” (the date at which the US Treasury is unable to cover the country’s debt payments and other expenditures such as Social Security payments) but we didn’t have the insight that it was coming up very quickly.

At the end of April (after the tax payment deadline), the US Treasury was able to get a sense of where their cash balances stood. Like any situation with complex cash inflows and outflows, there can be timing gaps between the cash flowing in versus when it needs to be paid out. The concern is that payments in May and early June may exhaust the Treasury’s cash balance before the next large revenue influx on June 15th. Earlier this Spring, Janet Yellen, Treasury Secretary, gave everyone a jolt when she said the X Date is early June, not July or August. She achieved her goal: peoples’ minds are now uniformly concentrated on the potential crisis, which could be as near as a few weeks away.

What about Congress reaching a compromise and passing legislation to increase the debt limit?

Congress works best with a deadline, and if there has ever been a serious “hard stop,” this is it. The respective parties are now talking after a long stalemate. Of course, the situation is extremely fluid, and they are meeting every single day. Positive signs include the fact that they are meeting daily, that they are not trashing each other publicly (for the most part), and that they all recognize a deal is needed at least one week before the X Date. The prospect of a default is extremely unpopular politically – for both sides.

What could happen if there is a default?

Let’s start by looking at 2011 – the best point of comparison for this unprecedented situation. As a refresher, in 2011, the debt ceiling was ultimately increased before the deadline but only after considerable debate, contention, and delay. Congress resolved the crisis by passing legislation that allowed the debt ceiling to be raised over two phases. But importantly, due to the level of uncertainty and conflict, the credit rating of US Treasuries was downgraded by Moody’s.

In 2011, the economy was in expansion mode, and unemployment was high. This was before the Trump tax cuts, so the total level of US debt was much lower than it is now. At the same time, Europe was having its own financial crisis due to worry about defaults, making those markets less attractive by comparison. Thus, the US dollar held strong and its place as the global reserve currency was never questioned.

Today, our national debt is significantly higher due to tax cuts and stimulus spending during the pandemic. The good news is that the world still has an appetite for US debt, so we can still borrow at reasonable rates (for right now, at least). Today, there is no rationale for continued fiscal stimulus and there continues to be concern about a looming recession. Partisan rancor is stronger than ever, and the new House Speaker is highly motivated to keep his job. All things considered, the powers that be are playing a very dangerous game, and the price of political miscalculation will be high and paid by all of us. More on that price below.

How are the markets doing right now?

Many experts who we follow agree that a deal is more likely than not and put the odds at 85% or higher for a deal before the deadline. This means, however, that the risk of default is not zero. Even if you don’t expect a default, this situation is causing high uncertainty – which translates to greater volatility in the markets.

So far this year, the equity markets have been much more focused on getting inflation down, coping with rising interest rates, and worrying about a looming recession. Right now, the markets are assuming there will be a deal, though as we get closer to the cliff’s edge, we may see a significant market sell-off.

What is likely to happen if a deal is reached before the deadline?

This is, of course, the easy and happy scenario. We may have some sleepless nights between now and then, but, in the end, we can still avoid a self-inflicted wound of national scope. With news of a deal, most experts expect a rally. Once things are resolved, the uncertainty is abated. So while it might be tempting to run for cover now, doing so could mean missing out on this rally – which could have a big impact on your long-term investment results. In such cases, we want to stay diversified, as we would in anticipation of any extraordinary and unpredictable shock to the system.

In the case of a default, what kind of financial market turmoil can we expect?

This is an unprecedented scenario, and truth be told, no one knows for certain what would happen. There are short- and long-term consequences (intended or otherwise) that will likely come into play.

What about the Short Term?

Most experts are emphasizing this will be a deferral of payment, not a traditional default. If an agreement is not reached in time, it is possible that the US Treasury misses interest payments on bonds and on other expenditures such as Social Security. The expectation is that a breached deadline will mean a delay of payment, not a cancellation or default. For example, interest payments may be delayed but bondholders will be made whole once the debt ceiling is raised. If there is a delay, bond maturities are likely to be rolled forward for each successive day.

There has been talk in the media about prioritizing some payments over others, but that proves to be extremely difficult (if not impossible) from a logistical standpoint. The Federal Reserve has talked about its own operational contingencies and, as in prior financial crises, its role will be to do all that it can to maintain liquidity in the system. Even though a delay is not a default, there will be logistical issues that undermine the “financial plumbing” of the financial system. It is also important to remember that none of this has been tested in real-time. Contingency plans are crucial but until tested, uncertainty remains.

Bottom line, if the deadline passes without a deal, pressure on Congress and the White House will be overwhelming. We can expect extreme volatility and negative impacts for nearly all asset classes. As in any market shock, there will be a flight to quality which could include gold and, counter-intuitively, US Treasuries.

What about the Long Term?

It’s hard to calculate or predict the long-term impact of a default but we know it will be disadvantageous to the US and global markets. It will have a severe negative impact on the role of the US and the US dollar in geopolitical terms. There will likely be a further downgrade by the credit agencies. The Federal Reserve may be put into a position to cut interest rates sooner than they may otherwise plan to do so. Long run, a default weakens the US dollar and will bring back into question the status of the US dollar as the world’s reserve currency. It could be the straw that breaks the camel’s back and tips the US economy into a recession. If the default endures, everyone will hunker down, and retreat to a “wait and see mode,” and that widespread pause will have a negative impact on our GDP. In other words, nothing good will come of it – and due to the unprecedented nature of the event, predictions are interesting but just that, predictions.

What does this mean for my portfolio?

When considering the potential impact of a default on clients’ portfolios, we feel it is important to remember there will be a short-term shock and, once resolved, a return to normal. That return to normal could be relatively quick or more drawn out, depending on the duration of any default. As we often say during extreme market volatility, “Don’t try to catch a falling knife.” While we don’t rule out the possibility of a default, if it does happen, we expect it to be short-lived.

What are we doing now?

We are reviewing your portfolio for liquidity and diversification. We are aiming to have any anticipated cash needs for the next 6-9 months available in a money market fund. This will ensure that your cash needs are met regardless of what happens and will allow us to be patient as the markets recover. As always, we will also rely on diversification to help us weather this storm. While this is unprecedented, we have weathered financial turmoil over the last couple of decades. This turmoil may become extreme, but our investing principles will continue to guide us.