We all know that money is not the most romantic topic of them all. However, finance plays an important role in any partnership. An open dialogue between partners is a great way to make sure that you remain on the same page (or at least understand where the other is coming from) when it comes to the things that matter most.

Enter, the Money Date.

Like the name suggests, a money date is simply a prescheduled date during which you and your partner have a frank conversation about finances. Pick your favorite restaurant, coffee shop, wine bar, or ice cream shop and settle in for an honest conversation. (Note: you certainly don’t have to go out to conduct a money date. If you feel more comfortable having your discussion at home, by all means, settle in! The important thing is that the date is pre-scheduled, allowing you both time to think through what you’d like to contribute to the conversation.)

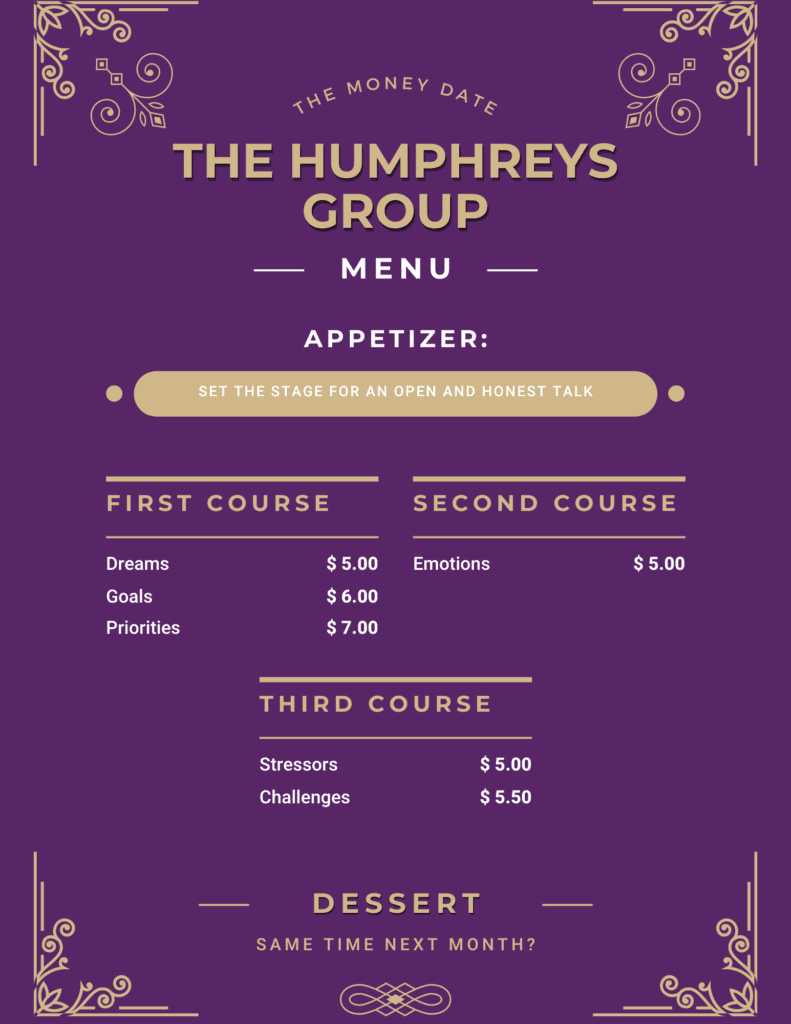

What’s On The Menu

While there is no set outline for the money date, there are some things you should be sure to touch on. Here, we lay out what your money date might look like.

The Appetizer

At the start of the meal, take a moment to check that both partners feel comfortable. The money date should be a safe space where each person feels that they can be honest, open, heard, and free from judgement.

The First Course

When it comes to discussing money, it’s best to start with the big picture. What are your goals and priorities? What are your values? Why is money important to you and what role does it play in your life? At this stage of the date, skip the nitty gritty details of budgets, bills, and industry jargon, and bring the conversation back to you, your partner, and your life together. Ultimately, this conversation should be about the two of you, your life’s desires, your individual and shared resources, and how you will move forward to build the life you both dream about.

The Second Course

As we frequently remind our clients, emotions and money are deeply interlinked. Therefore, it’s important to invite your emotions into the conversation. Dig deep and reflect on why you think about money the way that you do. If you and your partner view money differently, explore why that is.

The Third Course

Remember to also take note of any stressors that surface throughout the conversation. Does your partner tend to overspend? Perhaps that’s something that triggers stress for you. Do you feel anxiety when you think about saving up for your child’s education? Be sure to mention that to your partner. While we encourage you to try your best not to let stress overtake the conversation, noticing what triggers negative emotion can be constructive as you move forward.

Dessert

You did it! Wasn’t that sweet? You’ve undertaken your first money date, but don’t let it be the last. Whether you choose to check in once a month, once a season, or once a year, periodically sharing your thoughts, feelings, and goals with your partner will help to strengthen your financial present, as well as your financial future.

Dig Deeper with The Humphreys Group

Getting into the habit of conducting money dates is a great way to keep your communication consistent and your relationship open and honest, but we understand that sometimes money matters are a bit more complex than sharing priorities and goals over a bottle of wine. If you’d like professional guidance, please don’t hesitate to get in touch with our team!