After a long holiday weekend spent social distancing and in the comforts of our own homes, we started a new week that saw mixed results for the markets. U.S. stocks floated between positive and negative territory between Monday and Friday, following a winning streak last week.

A key reason behind the back and forth? Investors received new data this week that showed just how much the COVID-19 pandemic and the resulting shutdowns have weighed on the economy. In the past four weeks, unemployment claims have reached 20 million, while numbers from the housing industry showed slowdowns in many regions across the country and retail sales dwindled.

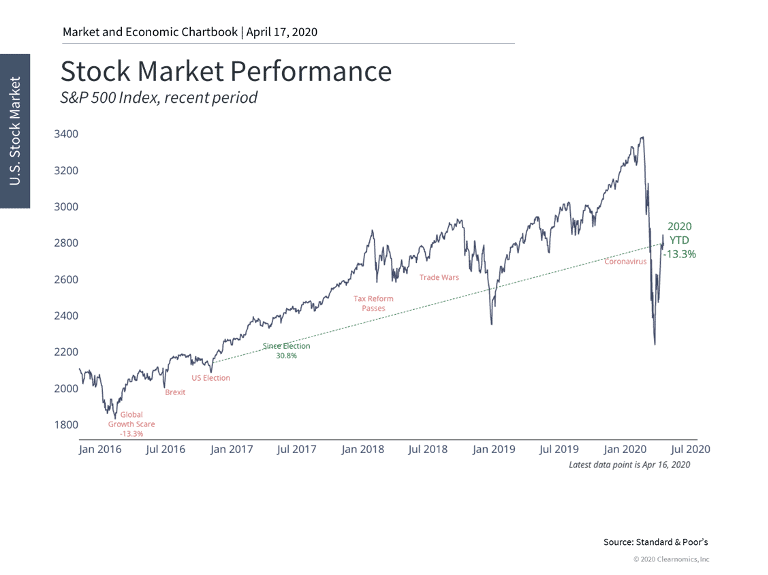

Stocks were buoyed by the federal government releasing new guidelines on Thursday afternoon for states to reopen amid COVID-19 shutdowns (though they don’t lay out a specific timeline). The markets ended up closing the week on a positive note, with the Dow Jones Industrial Average (DJIA) up 700 points higher at 2.99%, the S&P 500 up 2.68%, and the Nasdaq up 1.38%.

Policy Update: The Paycheck Protection Program

What’s new in terms of government policy?

On Thursday morning, the Small Business Administration announced that its $350 billion Paycheck Protection Program (PPP) has run out of funds, leaving many small businesses and nonprofits unable to apply for emergency loans that would help maintain their payroll during the ongoing COVID-19 crisis. This news comes after a notice was sent to banks Wednesday night that the program was on the verge of being depleted.

In terms of next steps, Treasury Secretary Steven Mnuchin and Democrat lawmakers intend to reconvene to discuss an interim package that would immediately add another $250 billion to the fund. We’re keeping an eye on this developing situation and will share new updates with you when they’re released.

Putting the Economic Downturn into Perspective

There is no getting around the fact that the economy is experiencing a deep contraction this quarter; it’s an event that many economists and experts have expected since the pandemic first swept across the country in March. While some industries (for instance, education and professional services) have been able to function remotely in light of widespread stay-at-home orders, other industries — such as transportation, leisure, and hospitality — have shut down completely, which significantly hampers economic growth.

But there is reason to believe that once the pandemic dissipates, businesses reopen, and more Americans return to their day-to-day routines, the economy will rebound quickly and strongly. Labor economist Edward Lazear — The Davies Family Professor of Economics at Stanford University and former Chairman of the President’s Council of Economic Advisers — recently offered some perspective on the current economic downturn and explained why our current situation is different from other crises, such as the 2008 financial crisis.

“This is a very different phenomenon,” Lazear said, noting that our current economic downturn is supply-based, as opposed to demand-based, since the COVID-19 pandemic has shut off the supply of business activity and labor to the economy. Supply-based downturns are more “V-shaped,” in that they go down quickly, and come up quickly. “In some sense, I would expect demand to be higher in the future, not lower. The reason for that is because there is a good bit of pent-up demand right now,” Lazear said, citing that many Americans would be actively participating in the economy — for instance, eating out at restaurants or frequenting shops — if not for social-distancing and stay-at-home orders, especially since the economy was on strong footing prior to the pandemic taking place.

Strong prospects for economic recovery don’t change the fact that this downturn will have long-lasting effects, such as a reduction in human capital and productivity loss. Among investment experts and economists, there is debate as to the shape and duration of the recovery when it does happen, for example, V-shaped or U-shaped. But as Lazear and other economists (such as Federal Reserve Chairman Jerome Powell) have mentioned, the sooner we are able to get the pandemic under control — either by reducing the spread of transmission through continued social distancing or treatments — the sooner the economy will be able to bounce back.

How Can You Prepare Yourself for a Downturn?

It’s true that we are facing a tumultuous time for our global and national economies. The upside is that we have been here before and have the benefits of hindsight. Not only is our team working behind the scenes to ensure your long-term investment strategy is equipped to withstand these uncertain times, but there are other planning-based actions we’re taking today in order to safeguard your personal finances from economic turmoil:

1. Make Debt Management a Priority

Debt management is an integral part of our financial planning process, and it’s one that becomes essential during periods of economic unrest. If you have any outstanding high-interest debt, focus on paying it down now (especially while you’re staying at home and your spending has decreased). Our team can help take a look at any debt you (or your family members) have accumulated and implement a plan for paying it down within reason.

Bonus tip: If you or your (grand)children are still paying off federal student loans, the government has officially suspended payments for the next six months. Use a portion of those funds to put an even bigger dent into your higher-interest debt.

2. Focus on Building Your Emergency Fund

Preparing for the unexpected is a topic that is always part of our planning conversations with clients, as proactivity is crucial to financial security. If you or someone you know (such as a child or family member) has endured a job loss due to the pandemic, it’s important to revisit emergency-fund savings to ensure living expenses and other essentials can be covered. If you are fortunate to still be working and have no disruption in pay, then take this time to allocate extra dollars to your emergency fund to prepare for the unexpected. A good rule of thumb is to have three-to-six months of living expenses set aside in case of an emergency.

3. Revisit Your Cash Flow and Spending Plan

As part of our financial planning process, we stress-test our clients’ situations against various life scenarios, including the possibility of an economic downturn. One key item we review is spending and cash flow, including where to cut back in case of a sudden emergency, which becomes even more important to our clients who are in or nearing their retirement years. Times like these underscore why these conversations are so important, and we’ll continue to have them (albeit virtually) as the weeks go on.

4. Maintain Your Long-Term, Diversified Portfolio

This is an investment principle we repeat time and time again to our clients. Maintaining a portfolio that is broadly diversified across a wide range of international and domestic asset classes helps mitigate risk and improves your chances of achieving higher expected returns over a long-time horizon. We pair our clients’ long-term investment plans with proactive strategies like tax-loss harvesting and ongoing rebalancing to successfully navigate large market swings.

It can be hard to maintain a positive outlook when you’re faced with dismal news headlines. We just want to remind you that we are here for you as more than just your financial advisor. We are here to listen to your questions and concerns, provide guidance, and offer peace of mind in knowing your financial life is taken care of. If you have any questions or simply would like to chat, please don’t hesitate to reach out to our team. Be well and stay safe.

Disclosures

The S&P 500 is a market capitalization-weighted index that tracks the 500 largest companies listed on the New York Stock Exchange or NASDAQ Composite. It is used as a benchmark of the overall stock market’s performance.

Return data represent past performance and are not indicative of future results. Historical performance does not reflect applicable transaction, management or other applicable fees as noted, the incurrence of which would decrease hypothetical, historical returns.

Source for all charts and text contained within graphics: © 2020 Clearnomics, Inc. All Rights Reserved. The information contained herein is proprietary to Clearnomics and/or its content providers and may not be copied or distributed. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness or correctness of the information and opinions contained herein. All reports, charts and graphics compiled by Clearnomics or any of its affiliated websites, applications or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and any commentary for any and all markets should not be construed as a recommendation to buy, sell or hold any security – including mutual funds, exchange traded funds or company stock.