It’s a new month, and a new chapter for the global markets, economy, and policy space. Below, we’re taking a look at some of the most important updates you should know, plus tips to help you capitalize on some of the latest developments.

What Happened in the Markets?

In our last two letters, we compared the market’s recent activity to being on a roller coaster ride, with new surprises around every turn. We couldn’t think of a better symbol for the market’s performance over the past few days.

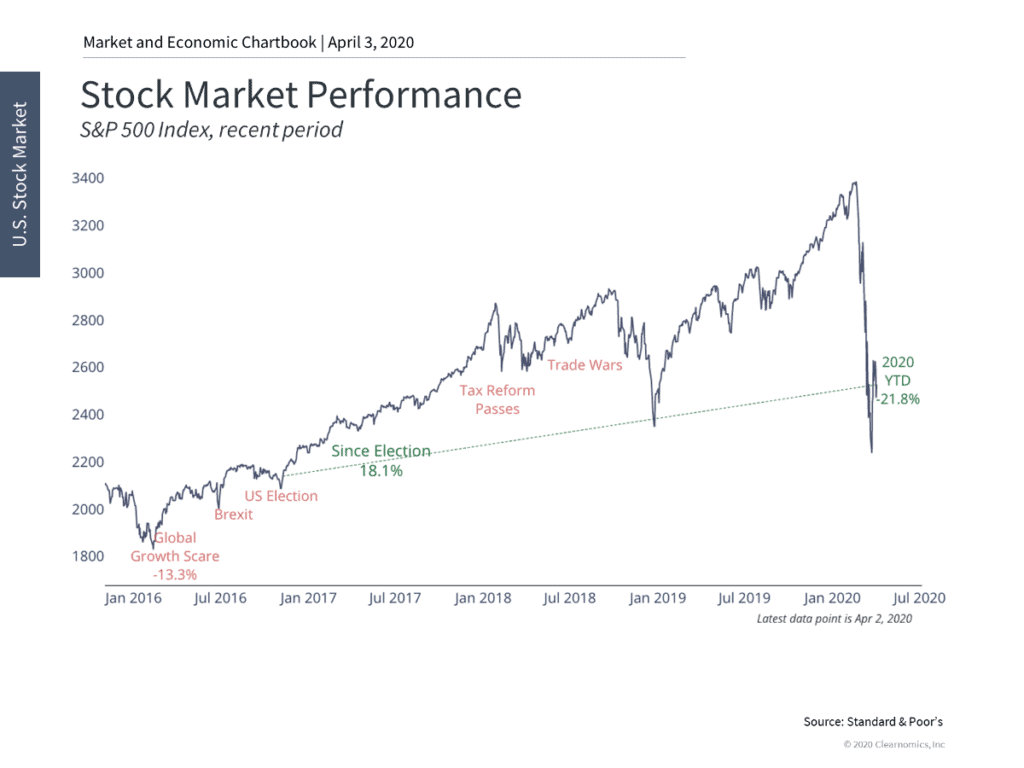

During the week of March 23, the S&P 500 recorded its best week since March 2009 — just one week after its worst week since October 2008 — and the Dow Jones Industrial Average turned in its best weekly performance since 1938. After consecutive weeks of massive declines and volatility that had investors’ nerves on edge, the surge in positivity was a welcome surprise. But it left us wondering: would the rise continue?

Last week saw mixed results. On Tuesday, the Dow soared 3,736 points (more than 20%), but ended the week more than 350 points lower, as job losses hit an 11-year high. Meanwhile, the S&P 500 started the week on a good foot, coming back from its March 23 low, but closed near 2,488 on Friday, down 38 points.

Keep in mind that there were only 23 trading days between the S&P 500’s record high in February and its recent low. It has certainly been an interesting ride the past few weeks.

What Lies Ahead?

Through all of the ups and downs we’ve endured recently, it’s important to maintain perspective. Many people often assume that the stock market’s current level offers insight into where it may head in the future. When the Dow hit a record high in February, for instance, pundits and talking heads were speculating whether it had peaked and would inevitably reverse in the coming weeks, proclaiming that the worst was yet to come. When the markets turned out a poor showing in the first few weeks of March, the prognosticators were back at it again, predicting how much further it would decline until things started to turn around. Round and round they went.

Formulating your investment decisions around predictions about the market’s current level or recent performance is just another form of market timing, which will ultimately result in a poor investment experience over the long term.

With this in mind, it’s important to consider a difficult but real possibility — that more volatility could be on the way. The most recent period to which we can compare our current state is 2008. Between September 2008 and December 2008, the S&P 500 notched six different rallies of 9% or more; however, as most of us remember, the market then bottomed out in March 2009. It was difficult to stomach, and for many investors, very unpredictable.

The COVID-19 pandemic has triggered economic disparity for many Americans across the country, which makes any positive news about the market bittersweet. Initial jobless claims spiked from 3.3 million to 6.6 million recently, further underscoring that the economic effects of this crisis will be long-lasting. Though the government has taken a major step in mitigating the impact with the Coronavirus Aid, Relief, and Economic Security (CARES) Act (more on that below), we will likely see more uncertainty until the virus has stopped spreading, and more Americans can go back to work and participate in our local and national economy.

What Should You Keep in Mind?

How can you, as a long-term investor, navigate this uncharted territory with no clear-cut map to tell you what lies around the bend? Here are three key takeaways:

1. Address Asset Allocation Drift Through Rebalancing

The recent volatility presents the perfect opportunity for you to rebalance your portfolio’s asset allocation back to target so you can increase your chances of capturing higher expected returns while maintaining your desired level of risk. This is a proactive, smart strategy that doesn’t involve timing or stock picking in an attempt to beat the market (a loser’s game).

2. Take a Second Look at Your Investment Strategy

While you’re reviewing your asset allocation, it’s also a good time to re-evaluate your portfolio guidelines overall. Remember that our asset allocation targets for you are based on your time horizon, income needs, asset base, tax profile, and the combination of your risk capacity and risk tolerance. Are you a younger investor with a long-time horizon ahead of you? Are you investing aggressively for a goal that’s taking shape within the next five years? What are your sources of income, and are they fixed or variable? We are always available to discuss whether you should perhaps adjust your strategy to better harness market volatility and leverage it to capture higher expected returns. Just like the 2008 Great Recession, this is a real-time learning lab for how we tolerate risk, as theory turns into reality.

3. Review Your Retirement Plan and Seek Opportunities to Benefit from the CARES Act

As we’ll discuss below, there are a number of provisions in the new legislation that benefit retirees and those who are nearing retirement. One of the biggest components: required minimum distributions (RMDs) have been suspended for IRAs and 401(k) plans. We’ll be discussing how you might take advantage of these provisions to boost your retirement income or fast-track your path toward achieving your savings goals. Stay tuned.

Above all, remember that a little perspective can go a long way toward improving your long-term investment experience. Bear markets are a normal aspect of the market cycle. Recessions are a normal function of the economy. We have survived poor conditions in the past, and the comeback has often been more memorable than the downturn. Whether the market rebounds, or we face more volatility in the coming weeks, your best strategy is to stay focused on your long-term financial plan and investment goals and tune out the noise.

The Latest in Policy: Breaking Down the CARES Act

On Friday, March 27, President Donald Trump officially signed into law the bipartisan CARES Act. This $2.2 trillion stimulus package — the largest in US history — is intended to provide economic relief to individuals and businesses affected by the COVID-19 pandemic.

At this point, you’re probably aware of the $1,200 direct payments to individuals, and the funds available to small and large businesses — so today, we wanted to give you a breakdown of some lesser-known provisions that could have a major impact on you and your family:

Small Businesses:

- Employers will be allowed to delay the payment of their 2020 payroll taxes until 2021 and 2022.

Individuals:

- Individuals will benefit from a 120-day suspension on evictions for any renters whose landlords have mortgages backed or owned by Fannie Mae, Freddie Mac, and other federal entities. Landlords also can’t charge any fees or penalties for nonpayment of rent during this time.

Unemployment:

- Self-employed workers — including gig workers, freelancers, and independent contractors — are now eligible for unemployment benefits.

- Part-time workers who lost their jobs and workers who can’t get to their new jobs because of the pandemic are also eligible for unemployment benefits.

- Unemployed workers who recently exhausted their benefits are allowed to sign up again.

Retirement:

- As we stated above, RMDs from IRAs and 401(k) plans are suspended. This provision is intended to stop retirees from being forced to sell investments that have probably decreased in value since the beginning of this pandemic.

- The 10% early withdrawal penalty for distributions of up to $100,000 for COVID-19-related purposes will be waived. Furthermore, withdrawal taxes can be spread out over three years from the date you took the distribution or rolled back into your account before those three years are up.

- The bill doubles the 401(k) loan limit from $50,000 to $100,000 for those affected by the pandemic.

- If you were supposed to finish repaying a 401(k) loan before December 31, you will now get an additional year.

Student Loans:

- Payments for student loans held by the federal government will be automatically suspended until September 30 without penalty to the borrower.

- Interest will not accrue on the loan during the suspension period.

Charitable Contributions:

- Donors can now deduct 100% of cash gifts to a public charity against their 2020 adjusted gross income. The old deduction rules will still apply to cash gifts to private foundations.

While the CARES Act is good news for businesses and individuals across the country who are struggling, additional legislative measures will likely be needed to stem-the-tide of this economic crisis. We’ll continue to keep an eye on the federal government’s actions in the weeks to come.

Last But Not Least — Show Us Your Space!

As we all get accustomed to our “new normal” in the world of social distancing and shelter-at-home orders, many of us are working from home and staying connected with colleagues and clients from afar. If you’re finding yourself in the same boat, we’d love for you to share a photo of your new workspace with us! We’ll be sharing some fun snapshots of our WFH arrangements on social media and hope you’ll be following along. Send your own photos to our team at katie@humphreysgroup.com — and as always, please contact us if you have any questions.

Disclosures

The S&P 500 is a market capitalization-weighted index that tracks the 500 largest companies listed on the New York Stock Exchange or NASDAQ Composite. It is used as a benchmark of the overall stock market’s performance.

Return data represent past performance and are not indicative of future results. Historical performance does not reflect applicable transaction, management or other applicable fees as noted, the incurrence of which would decrease hypothetical, historical returns.

Source for all charts and text contained within graphics: © 2020 Clearnomics, Inc. All Rights Reserved. The information contained herein is proprietary to Clearnomics and/or its content providers and may not be copied or distributed. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness or correctness of the information and opinions contained herein. All reports, charts and graphics compiled by Clearnomics or any of its affiliated websites, applications or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and any commentary for any and all markets should not be construed as a recommendation to buy, sell or hold any security – including mutual funds, exchange traded funds or company stock.