No, it’s not actually a tax, and it doesn’t necessarily have to do with anything pink. If you’re not familiar with the term, “pink tax” refers to the premium that women are expected to spend for specific services or products marketed towards them, from haircuts to deodorant, and everything in between.

A Brief History of the “Pink Tax”

The “pink tax” officially dates back to 1994, when a report from California’s Assembly Office of Research found that 64% of stores in five major cities charged more to wash and dry clean a woman’s blouse than they did a man’s button-up shirt. Following the study, California passed the state-wide Gender Tax Repeal Act of 1995, making it illegal for a business to discriminate with respect to the price charged for similar services due to a person’s gender. However, without a doubt the pink tax still affects women today.

Think about the last time you scheduled a haircut. Did your salon have separate price lists for men and women? What about your car insurance policy? Financial journalist Beth Kobliner points out that women, especially those 40 and older, often pay more for car insurance than their male counterparts, even with identical driving records.

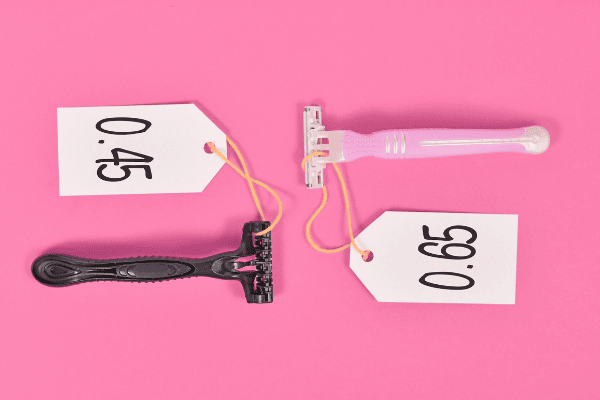

According to a Consumer Reports study, women’s products cost 7% more on average and up to 50% more overall than similar products marketed towards men. While it was found that this price gap is especially pervasive among personal care products like razors ($10.99 for a women’s pack, $10.49 for a men’s pack) and shaving cream ($2.49 for women, $1.69 for men), it is also prevalent among children’s toys and accessories, children’s clothing, adult clothing, home health care products for seniors, and more, according to the New York City Department of Consumer Affairs.

Furthermore, did you know that 27 out of 50 states still have a tax on tampons and other feminine hygiene products? Deeming tampons and sanitary napkins “unessential,” these states profit an estimated $120 million annually off of women. It’s worth noting that the “tampon tax” is a real tax, whereas the “pink tax” is actually a markup on goods, but it’s another example of the financial discrimination faced by women.

The Bigger Picture

While the “pink tax” is certainly an unfair financial burden on women, it unfortunately is just a small slice of a much larger and more problematic pie.

According to AAUW, women working full time in the U.S. are still paid just 83 cents for every dollar a man makes. It’s a gap that researchers say likely won’t close for another 37 years. This disparity has consequences that affect women throughout the entirety of their lives, from the opportunities they have when they’re just getting started on their career paths all the way to retirement. In fact, in terms of overall retirement income, it’s estimated that women have only 70% of the wealth men do.

What’s more, as we mentioned in this previous blog, underneath the wage gap is an even more daunting reality: the wealth gap. Data from the Federal Reserve revealed that women own only 32 cents for every one dollar owned by men.

What Can You Do to Avoid the Pink Tax?

If you’re angry just reading this, you’re not alone. So, what can you do to fight against it? Yes, you can buy gender-neutral products or products marketed towards men. (Is it fair? No. Is it economical? Yes.) You can also support change in legislation and use your voice to speak out against the injustice of the “pink tax.” One other thing you can do? Take control of your financial picture.

At The Humphreys Group, we applaud and encourage the many ways in which women are breaking through gender stereotypes. We have long championed women as they’ve scaled the learning curve of personal finance and investing, and we consistently strive to debunk the stereotypical myths that still permeate discussions about women and money.

Ready to rewrite the rules? Download our free book, which takes a deep dive into decades of research and data around women, money, and personal finance to distinguish myths from reality. Want to continue the conversation? Please reach out!