We’re capping off yet another interesting week for the markets, the economy, the policy arena, and the ongoing Coronavirus pandemic. Below, we’re providing you with a full recap of the latest news, plus what to watch out for as we head into next week.

What Happened in the Markets?

In our most recent recap, we asked you to “remember that while the markets are designed to handle uncertainty over longer time horizons, they tend to have a habit of behaving unpredictably in the short run.” Was that ever the case last week.

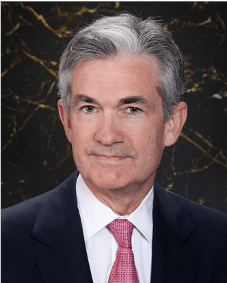

When markets closed on Friday, March 20, the S&P 500 had lost roughly 30% of its value from its February 19 peak, and suffered its worst one-week decline since 2008. It had all but wiped out all gains accumulated under the Trump administration. At the time, there was a Senate stimulus bill largely expected to pass over the weekend. The Fed had already cut interest rates to 0% and announced rescue measures around its bond-buying program to the tune of $700 billion. The global health crisis around COVID-19 had started its exponential climb in reported cases in the United States, with some experts labeling New York as the new epicenter of the outbreak. In short, many expected the substantial volatility we experienced that week to continue.

Instead, last week, the major indexes rallied for one of their best weeks ever. The S&P 500 posted its biggest three-day gain since 1933 and recorded its best week since March 2009 — just one week after its worst week since October 2008. The Dow turned in its best weekly performance since 1938. Despite paring some of their gains on Friday and finishing the session in the red, the S&P 500 gained 10.3% for the week, while the Dow gained 12.8%.

We’re not saying it will be smooth sailing from here on out, but it’s worth noting — investors who attempted to time the market after the March 20th close would have missed out on the quickest bear market recovery ever.

There were, of course, fiscal and monetary policy measures taken to stem the downward tide and ease investors’ fears. After two failed votes, the Senate passed a $2 trillion stimulus bill (full details below). The Fed announced Monday morning that there would be no limits to its bond-buying program, which had originally been capped at $700 billion, and announced new credit facilities, expanded liquidity pools, and announced the launch of a “Main Street Business Lending Program.”

But if the market performance feels disconnected from the economic reality for individuals, families, and business owners, it very well may be:

- By mid-week, up to 54% of the U.S. population may have been ordered to stay at home. (1)

- The services and manufacturing sectors experienced historic lows, based on early March data. Services business activity dropped to historic lows, while manufacturing experienced its sharpest drop since 2009. (2)

- Companies reduced their workforces at the highest levels since the 2008 recovery. (3)

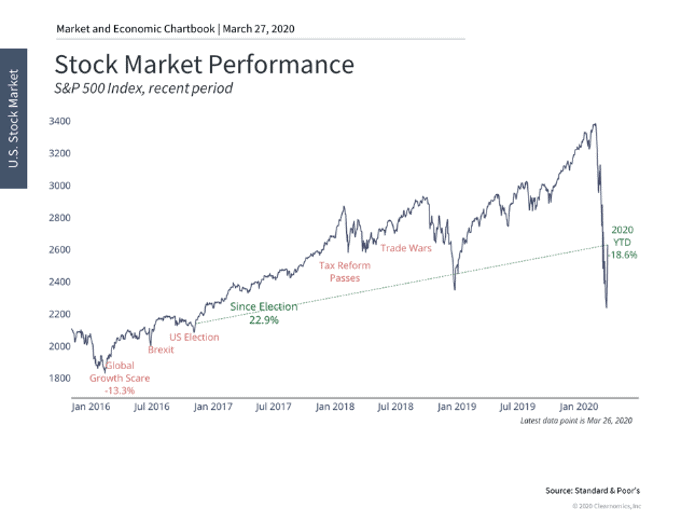

- On Thursday, the Department of Labor announced that a staggering 3.283 million people had filed claims for unemployment benefits in the week ending March 21. This was the highest number of claims in U.S. history and above most economists’ expectations (around 1 million).

- With a rough rule of thumb by economists of a 1% increase in the unemployment rate for every 1.5 million jobs lost, unemployment may nearly double from February 2020 levels.

It may be that this correction has already priced-in a sharp recession and economic distress, leading to lower expectations for consumption, production, corporate earnings and growth. It may also be the case that these are short-term fluctuations, as markets handle uncertainty and reassess expectations. We don’t speculate because we can’t predict what the future holds. We don’t know for certain how the COVID-19 public health crisis will play out, and we don’t know how the market will react to news — positive or negative — that arises from it.

Two of our last three Federal Reserve Chairmen made surprise appearances this week with the same message in mind:

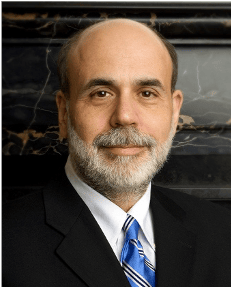

Ben Bernanke, who oversaw the Federal Reserve’s response to the 2008 financial crisis, said on Wednesday that our current economic halt resembles more of a natural disaster than a systemic monetary or fiscal shock. Bernanke said he expects a “very sharp” U.S. recession but a “fairly quick” recovery. Most importantly, he noted that “if we don’t get the public health right,” there’s no monetary policy by the Fed or fiscal legislation to overcome that.

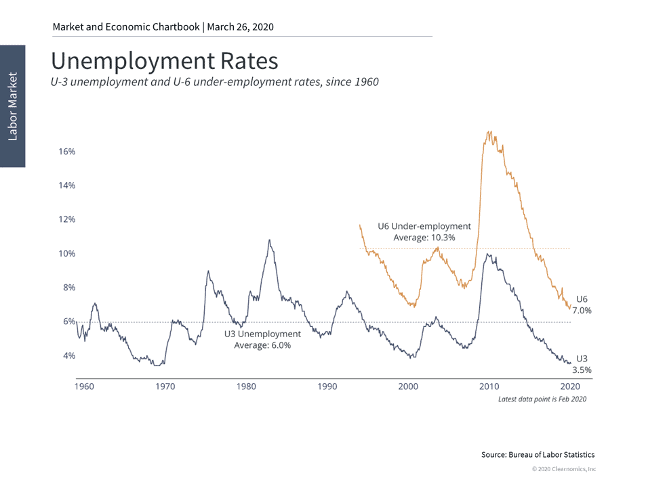

Meanwhile, current Fed Chairman Jerome Powell said on Thursday that we may be in a recession already, but that he “would point to the difference between this and a normal recession.” Powell added, “there is nothing fundamentally wrong with our economy … we are starting from a very strong position.” He echoed Dr. Anthony Fauci, one of the top scientists in the Coronavirus Task Force, that the timetable of a recovery would be dictated by the virus.

We would be remiss to ask long-term investors to ignore the noise and stay disciplined when it comes to pullbacks or corrections, and not request the same of rallies and gains. With the new normal of substantial volatility for the time being, nearly every trading session feels like a new loop around the roller coaster. We continue to take a long-term perspective of what’s to come.

What Should You Keep in Mind for This Week?

The recent roller coaster ride of dramatic selloffs and forceful rebounds illustrates an important concept that all long-term investors should remember: You are equipped with a toolkit that many investors do not have. You are investing with a portfolio that is well-diversified across multiple different asset classes, one that reflects your tolerance for risk and the goals for which you are investing. Your portfolio is designed to weather turbulent market conditions (which are a sign that the market is working as it should; volatility is not an anomaly), including moments like the one we’re experiencing now.

As we stated in our last letter, we’re no stranger to crises — we’ve been through events that have instilled fear and anxiety in all of us. These climates are never easy for investors, and the barrage of the 24/7 news cycle does not make life any easier. Remember these takeaways:

- The stress of being out of the market can be just as debilitating as the stress of being in the market. Not only do you need to pinpoint the exact time to get out of the market, you also need to predict the right time to get back in — a feat that is incredibly difficult to do.

- The benefits of “staying in your seat” during the roller coaster ride far outweigh the benefits of getting out. History shows that market advances are more frequent, last longer, and have greater magnitude than market declines.

- If you need another reason to stay put, let us remind you that excessive trading and turnover can result in hefty fees that could have a major impact on your ability to sustain long-term investment growth.

- Rely on proven, proactive strategies such as tax-loss harvesting and rebalancing to capture the silver lining of market volatility and maintain your target allocation or desired level of risk.

These takeaways, combined with the support of a fiduciary financial advisor, can be your best defense against market volatility.

What Happened on the Policy Front?

After a unanimous vote in the Senate, the House gave final approval Friday on the largest stimulus bill in modern American history. It is the latest legislative effort designed to bolster the U.S. economy during the ongoing Coronavirus pandemic.

Here is a breakdown of the bill for individuals, businesses, state and local governments, and hospitals:

For Individuals:

- Individuals who earn $75,000 or less would get direct payments of $1,200. These payments would phase down before ending altogether for those earning more than $99,000. Families would receive an additional $500 per child.

- They will also receive an expansion of unemployment benefits that would extend unemployment insurance by 13 weeks. Unemployed workers would also receive an additional $600 a week for four months.

For Large Businesses:

- Large businesses grappling with the Coronavirus pandemic will benefit from $500 billion in loans.

- Businesses that receive a government loan must halt stock buybacks for the length of the government assistance, plus one additional year. There would also be limits on executive bonuses.

- There would be strict oversight of these loans in the form of an inspector general and a five-person panel appointed by Congress.

For Small Businesses:

- Small businesses that keep up their payrolls during the Coronavirus crisis will receive $377 billion in loans at low or no interest.

- Small businesses that pledged to keep their workers on the payroll would also receive cash-flow assistance structured as federally guaranteed loans. These loans would be forgiven if the business continued to pay its workers for the duration of the crisis.

For State and Local Governments:

- $150 billion in funding, including $400 million in election assistance for 2020.

For Hospitals:

- $130 billion in funding, which is $55 billion more than what was originally agreed upon. $100 billion would go directly to hospitals, $1 billion would go to the Indian Health Service, and the remainder would be used to increase supplies of medical equipment.

“This is not a moment of celebration, but one of necessity,” Minority Leader Chuck Schumer said on the Senate floor Wednesday. “To all Americans I say, ‘Help is on the way.’”

Keep Calm, Carry On

We hope that you are all staying safe and prioritizing your health, while following the guidelines laid out by the CDC and WHO. Let’s end this week’s recap with some positive news:

- “Coronavirus relief: San Francisco’s The Liberties Bar makes it easy to give a meal to someone in need”: The Liberties Bar in San Francisco has delivered 130 meals so far, with some going to Homeless Youth Alliance and the drop-in shelter at A Woman’s Place.

- “Can San Francisco emerge from the coronavirus pandemic stronger? Heroic leaders, bighearted residents offer hope”: Acts of kindness, big and small, have made San Francisco a city to emulate.

- “San Francisco Fights Coronavirus by Finding the Homeless a Home”: San Francisco has leased trailers and hotel rooms to quarantine homeless people showing signs of infection; the city is also moving some of the 2,000 people in its shelters to new locations so they aren’t crowded together.

In the meantime, please continue to stay tuned for more updates on the news and events that impact your day-to-day financial life. If you have any questions or simply would like to discuss some of your concerns about our current environment, please contact us at 415-928-0401. While we are working remotely, it may take a short time for us to return your call, but we will do so before the end of the day.