In the world of investing, human psychology often leads us to focus on short-term results. We tend to review investment outcomes by calendar year and assess long-term returns over 10-year periods. This preference for neat, easily digestible data can sometimes cloud our judgment, leading to recency bias, where we place undue emphasis on the most recent performance. However, when it comes to understanding equity premiums, this narrow perspective can be misleading.

A Decade of Volatility

Over the past decade or so, despite periods of market turbulence and uncertainty, equities have exhibited robust performance, with the MSCI All Country World IMI Index achieving an annualized return of 8.49% by the end of 2022. However, it’s essential to look beyond these headline numbers and consider some of the subtleties. What do we mean by equity premiums? When we focus on the long-term drivers of expected equity returns, the data tells us that company size, relative price, and profitability matters greatly. Within the equity markets, stocks with higher-profitability consistently outperformed lower-profitability stocks across the globe. Additionally, small-cap stocks outperformed large-cap stocks outside the United States. One noteworthy anomaly, however, was the underperformance of value stocks. Despite a strong rebound from late 2020 through 2022, the MSCI All Country World IMI Value Index delivered an annualized return of just 7.25% over the past decade. Although this has required patience on the part of value investors, the data does show a “value premium” over longer time periods.

The Occurrence of Negative Premiums

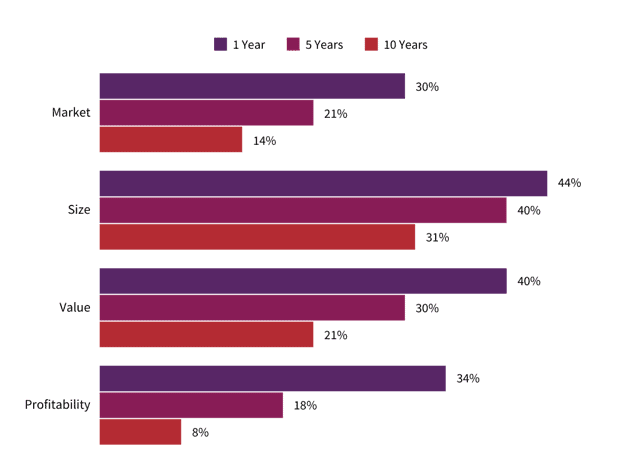

To gain a more comprehensive perspective on equity premiums, we must acknowledge their inherent variability. Negative premiums, while not the norm, do happen. The table below illustrates the frequency of experiencing a negative premium in US equity markets over rolling one-, five-, and 10-year periods. It’s evident that even in the most robust markets, periods of underperformance occur from time to time. However, it’s important to remember that while a positive premium cannot be guaranteed, the odds of realizing one remain distinctly in favor of long-term investors, and these odds tend to improve the longer one stays committed to their investment journey.

Short-Term Performance: No Crystal Ball

While it’s tempting to draw conclusions about future premiums based on recent results, the reality is that the past performance of premiums over shorter horizons doesn’t offer a reliable crystal ball. The dynamics of the market are influenced by countless variables, making it impossible to predict with certainty how premiums will behave in the short term. This unpredictability underscores the importance of a long-term perspective in investment decision-making.

The Swift Emergence of Premiums

One aspect of premiums that might surprise some investors is how quickly they can materialize. Market conditions can change rapidly, leading to the emergence of premiums where none were evident before. This phenomenon further underscores the need for patience and discipline in sticking to your chosen investment strategy. A willingness to weather short-term fluctuations can ultimately yield rewards when premiums do materialize.

Final Thoughts

When it comes to equity investing, a perspective on premiums is crucial for making informed decisions. While the allure of short-term results can be enticing, it’s essential to recognize the inherent variability in premium performance. Ultimately, investors who maintain a long-term perspective, stay disciplined in their approach, and resist the temptation to react impulsively to short-term fluctuations are more likely to realize the benefits of equity premiums.

Now, we invite you to take action. In the ever-evolving world of investing, it’s crucial to partner with professionals who prioritize your financial security and prosperity. Consider reaching out to The Humphreys Group team to explore how our seasoned expertise and disciplined approach to investment can help you achieve your financial goals. Let’s embark on a journey of financial empowerment together, where your investments are managed with a steadfast commitment to your long-term success, and where the science of capital markets guides your path. Your financial future deserves nothing less.