The buzz about electric vehicles (EVs) seems to be ubiquitous these days. As they become increasingly visible on the road, they’re also frequently in the headlines. Last year, the State of California announced it will require all new vehicles to be fully electric by 2035. Shortly after that, the passage of the Inflation Reduction Act introduced a federal tax credit for new EV purchases. This credit specifically has piqued some interest, and recently some have begun to ask: is now the time to buy an electric car?

Of course, the answer to that question relies on several factors. Let’s take a deeper look.

Qualifying for the Clean Vehicle Tax Credit

Whether you qualify for the tax credit depends on two sets of requirements. The first set focuses on the vehicle itself, while the second set pertains to your adjusted gross income (AGI).

- EV Requirements: First, the car must be a new EV (that is, not used), for your own use (not for resale), and must be assembled and used primarily in the United States. The vehicle must be delivered, or “placed in service,” between 2023 and 2032 (the purchase date is irrelevant). For vans, SUVs, and pickup trucks, the manufacturer suggested retail price (MSRP) must be $80,000 or under, and for all other vehicles, the MSRP must be $55,000 or under.

- Income Requirements: Your AGI must not exceed certain limits: $300,000 for married couples filing jointly, $225,000 for heads of households, and $150,000 for all other filers. You can use your AGI from the year you place the vehicle in service or the previous year, whichever is lower. As long as your AGI falls below the applicable threshold in at least one of these two years, you can claim the tax credit. (If you’d like to confirm your AGI on your 2022 tax return, you can reference line 11 on your 1040.)

Calculating the Clean Vehicle Tax Credit

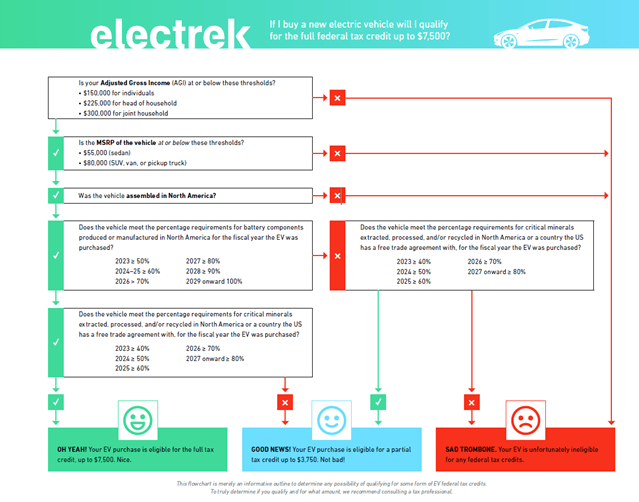

Assuming you meet the vehicle and income requirements, the amount of your tax credit depends on fairly technical criteria related to the components and mineral sourcing of the EV’s battery. If the car meets both the battery components requirement and the critical minerals requirement, it is eligible for the full $7,500 credit – in other words, your total tax bill will be reduced by $7,500. If it meets only one requirement, you may only be eligible for a partial credit of $3,750.

These policies are in place to improve battery manufacturing and mineral extraction in the United States, and the minimum standard increases almost every year between 2023 and 2032. If you’d like to qualify for the full credit, we strongly suggest visiting www.fueleconomy.gov/feg/tax2023, which has the most up-to-date information on eligible models. We also love this flowchart from Electrek, which provides an overview of the details and tax credit calculations.

Additional Considerations Before Buying an EV

As great as tax credits are, you’ve likely heard us say that we never want the “tax tail to wag the dog” – in other words, most financial decisions should not be made for tax reasons alone. Here are a few additional considerations (besides the environmental benefits) that may help you determine if it’s time to buy an EV:

- Condition of your current car: Is your car already fuel efficient, or is it a gas guzzler? Is it a fairly new model, or do you fear it will kick the bucket soon? Although car prices have fallen slightly since the pandemic, they are still relatively high. If you have a newer, fuel-efficient car that meets your needs, putting off a car purchase until you really need it is best from a financial standpoint and allows you to get the most out of your existing vehicle. Keep in mind that the Clean Vehicle Tax Credit will be in place until 2032, so you have plenty of time to take advantage of it.

- Driving patterns: Do you have a long or short commute? How often do you go on road trips? The range of most EVs tends to be sufficient to cover the average driver’s daily mileage, but it’s a good idea to track your mileage to ensure an EV can meet your needs.

- Financing plans: Interest rates remain high, so if you expect to finance the purchase of an EV, your bank account will thank you if you wait until rates fall. For depreciating assets like cars, we generally recommend financing only when you can secure a low-interest loan.

- Access to charging infrastructure: Do you have the ability and space to install a home charger? If not, are you willing to rely on public charging stations? Some chargers take longer than others, so familiarize yourself with the types of chargers available to you and their charging times. If you tend to take longer trips, examine the availability and convenience of charging infrastructure along routes you’re likely to take. Thankfully, the Department of Energy has a helpful map of charging stations.

- Cost over time: EVs tend to have higher upfront costs and lower maintenance costs compared to gasoline-powered cars, but your driving habits also play a significant factor in the cost over time. We suggest using the Department of Energy’s vehicle cost calculator, which incorporates your estimated mileage to help you compare the cumulative cost of ownership for EVs and gasoline-powered cars.

In conclusion, the buzz surrounding electric vehicles (EVs) is undoubtedly justified, given the increasing visibility of these cars on the road and the numerous headlines they generate. Ultimately, considering the potential financial benefits, the environmental impact, and the extended time frame for purchase, exploring the possibility of purchasing an electric car could be a wise decision for those who qualify for the Clean Vehicle Tax Credit. Please reach out if you’d like to dig deeper and share your thoughts or questions!

For More Information:

- The Department of Energy has lots of great calculators, interactive maps, and data searches to help with your EV research: https://afdc.energy.gov/tools

- The IRS website has more details on the qualifications and instructions on how to claim the credit: https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles-purchased-in-2023-or-after