By Hallie Kraus, CFP®, CRPC®

In the year that has brought us COVID-19, a nationwide reckoning with racial injustice and undeniable signs of climate change, many of us — often feeling otherwise helpless — have opened our wallets in an effort to help correct the inequities that have been laid bare in our country. This isn’t particularly unusual: whether we choose to make a donation to a local nonprofit organization, drop a bill into our church collection box or contribute to a GoFundMe page to help someone pay their medical bills, when life gets difficult, many of us have a natural inclination to use our dollars to make a difference in a way that we otherwise can’t. Of course, we don’t expect to see that money again, or to see it grow. We simply hope it will have an impact.

For decades now, many in the world of finance have taken this traditional model of philanthropy a step further through what’s commonly called “impact investing.” While there are many flavors of this rapidly growing segment of the investment industry, they are all based on the desire to make money and do good at the same time.

Of course, we at The Humphreys Group heartily endorse the increased interest in investing to promote social good. It is one of the most effective ways we can vote with our dollars and have our money and values aligned — which we have seen results in better financial outcomes. Because 2020 has given us no shortage of causes that are deserving of our help, we decided to mark this year by focusing on what it really means to be an impact investor and explore a new strategy that can help you have the impact you seek.

Impact Investing Approaches

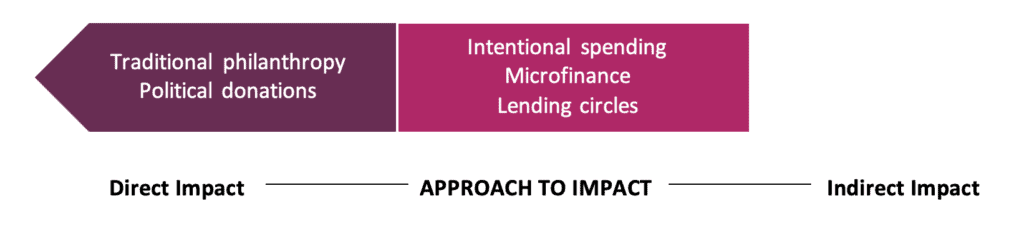

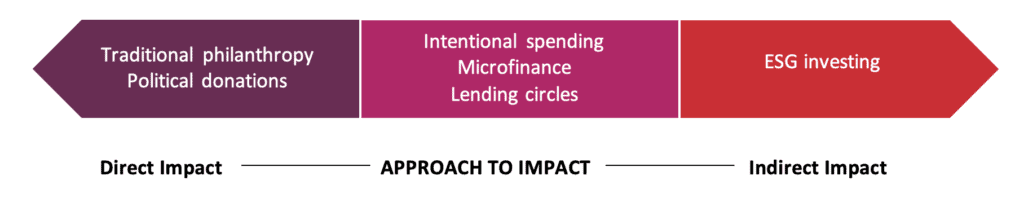

Let us start by acknowledging there are countless approaches to impact investing, and each depends on a variety of factors, including your resource level, your risk tolerance, your values and your goals. While we surely can’t cover each individual strategy, we think the best way to understand impact investing is to envision it as a spectrum, with direct strategies on one end, and indirect strategies on the other.

Direct Strategies: One End of the Spectrum

When we talk about direct impact, we’re referring to strategies you’re most familiar with, like charitable giving and political donations. They are approaches in which we often have a fair amount of control over where our money goes, generally know how the funds will be put to work, and rarely, if ever, expect a financial benefit.

Less Direct Strategies: The Middle of the Spectrum

As we get closer to the middle of the spectrum, we lose some of that control, but we’re still quite aware of how we’re effecting change. Perhaps we choose to practice intentional spending, like supporting businesses that are women-owned, Black-owned, or certified as a B Corp. Maybe we choose to participate in a program that provides loans to underserved populations, like a microfinance organization or lending circle. Remember that these strategies are less direct because, for example, you cannot instruct how a loan recipient or business owner puts your money to use. But you are still broadly aware of how your money is reflecting and advancing your values. In some situations, like a lending program, you may expect some interest or a small return on your investment.

Indirect Strategies: The Other End of the Spectrum

The best example of an indirect strategy is called ESG (environmental, social and governance) investing. It involves you (as an individual investor), buying shares of a mutual fund and essentially putting your trust in a number of intermediaries (portfolio managers, other shareholders and corporate executives) to use your money for good. In exchange, your investment is expected to grow over time. ESG investing is also one of the most accessible forms of impact investing, especially compared to those with a higher asset base, who might be better financially positioned to engage in more direct programs like microfinance or private foundation work. This indirect side of the spectrum is where wealth managers are most often engaged, and while ESG investing specifically can seem “hands off,” you may be surprised to know that it is an incredibly powerful way to bring about change.

Why ESG Investing Is So Effective

The reason ESG investing is so effective is because it’s multifaceted. While enabling us to proactively use our money to support that which we want to thrive, this strategy also leverages research, financial support, shareholder activism and policy development to apply pressure on the private sector to become more equitable and sustainable. And it happens to be at an inflection point. According to Morningstar, the first half of 2020 saw a record $20.9 billion flow into ESG funds — almost as much as the $21.4 billion in ESG flows in all of 2019.

As we’ve seen ESG investing evolve, we’ve grown more excited about its potential. In the next three blog posts, we’ll take a deeper dive at why this indirect strategy may actually become the future of impact investing. First, we’ll take a look at how it can influence business leaders to act more equitably, then we’ll talk through what investment decisions are being made within the fund, and in our last post, we’ll share our specific perspective and investment approach. After a long, difficult year, we think it will give us all a much-needed renewed sense of hope.

If you’d like to learn more about ESG investing, check out Part II of our blog series on the topic here.